Bitget margin trading(1)

2021.11.22 07:30

Hi It's Unicorn

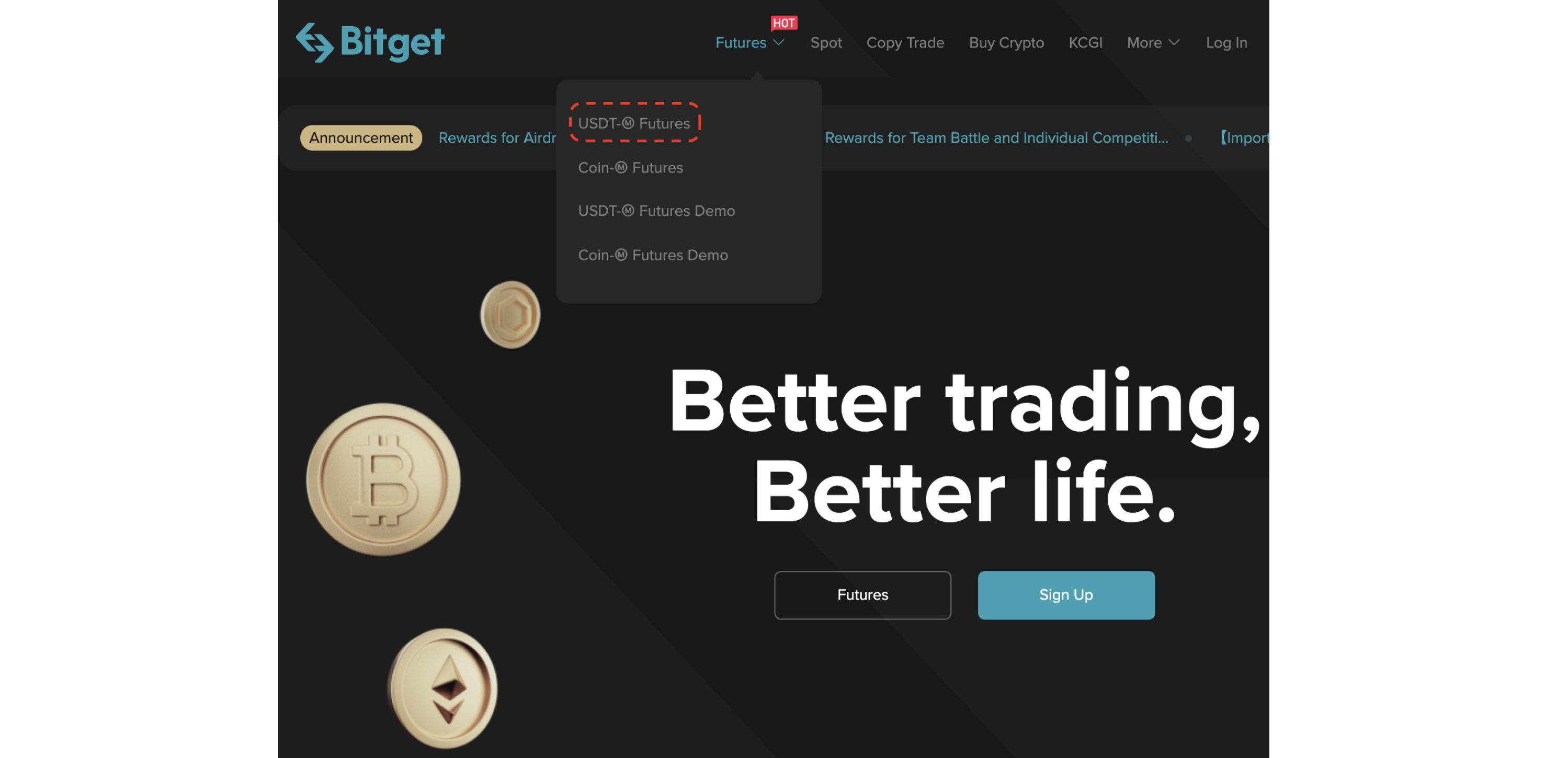

1. Futures Trading → Click USDT-M Futures!

➣ Log in Bitget, and click “Futures Trading” on the top! There are two type in futures trading, USDT-M & COIN-M.

➣ USDT-M is a derivative that uses Tether as collateral for short buying, short selling, and leverage.The advantage of USDT-M is that you are able to use stable coin USDT as collateral.

➣ COIN-M Futures use underlying currencies, such as BTC, ETH, etc., as margin. For instance, if you trade a BTC/USD pair, the settlement currency is BTC.

➣ Each has its pros and cons. For beginners, we recommend you start to trade USDT-M which is easier it understand. Here, we will focus on USDT-M futures!

2. BitGet trading interface!

(1) List of coin items

➣ In addition to the BTC/USDT pair, you also can see other coin pairs supported by Bitget in this section. You can monitor price changes in real time, and select the coin pair you like here, you will enter the trading interface of the coin pair directly.

(2) Coin status

➣ Here you can check various data such as 24-hour highs and lows / 24-hour trading volume / funding ratio.

➣ In addition to the specified coin, you can see the market prices of other cryptocurrencies at a glance; and you can directly enter to the trading page by clicking another coin pair you selected.

(3) Real-time chart

➣ This is a real-time chart that you can historical and current price movements, along with technical analysis tools. view and see the price of the specified coin.

➣ Here you can use the chart developed by BitGet or the chart of Tradingview. If you are used to viewing the chart of Tradingview, you can select the chart of Tradingview for trading.

(4) Order book

➣ In the order book, you can monitor real-time quotes and current transactions. When there are orders where the bid price is equal or higher than the lowest ask, those orders can be immediately executed and will not be in the open orders book anymore.

➣ An order book is a market price recorder. These price records help traders and also improve market transparency because they provide valuable trading information.

(5) Position status

➣ In this section, you can check position / open orders / order history / trade history / transaction history, etc. You can view a history of past executed orders, including your current positions. You can also view the transfer history between wallets.

(6) Order window

➣ Here you can enter your order. You can select the margin mode, investment direction (long or short), buy/sell price, input ratio and order method. You can use the trading strategy you like!

➣ If you see the bottom of order window, you can see Assets and Contract Information where you can check the balance, position, benefit, and various information about the contract you are trading.